MiFID for CIB clients

MiFID / MiFIR is a regulatory framework which sets high investor protection standards throughout Europe and regulates and harmonises trading in financial instruments. MiFID II is the revision and continuation of MiFID I due to changes in market structures as a result of the financial crisis and is particularly intended to increase transparency in the markets and the efficiency and integrity of financial markets.

The MiFID II Directive / MiFIR Regulation contains stricter rules for the sale of financial products to protect investors and will be implemented as of 3 January 2018.

MiFID II and MIFIR won´t result in changes to the range of products and services offered by UniCredit Bank GmbH.

Disclosure in relation to the European financial markets regulations (MiFID II)

Target group of the following information are MiFID Retail customers.

In line with the MiFID II regulation, UniCredit Bank GmbH provides you in the following with a cost information. The cost information shall inform you about all costs and charges in relation to the financial instrument before executing a transaction. It shall not in any way replace or amend our Terms & Conditions available HERE.

COSTS & CHARGES DISCLOSURE

Costs and charges can be divided into

- costs of the financial instrument,

- cost of investment services and/or ancillary services and

- third party payments (inducements).

Where applicable, inducements will be disclosed separately as part of the cost of investment services. The aggregated costs and charges are calculated and expressed both as an Euro cash amount and percentage based on an assumed notional amount. Costs are presented in aggregated form and can be divided into entry, running and exit costs.

The costs and charges reflect estimates valid under normal market conditions and are calculated based on past experience and market practices. All information will be kept up to date.

For OTC derivatives, costs and charges generally only relate to costs of the financial instrument. Running costs and exit costs do not apply, as OTC derivatives are assumed to be held until maturity. Costs and charges are depending on whether OTC derivatives are traded under a collateral agreement (collateralized) or non-collateralized. For further information, please refer to your individual collateral agreement or contact your personal UniCredit Bank GmbH sales representative.

Please find below a table for all costs and charges divided into product groups, maturity and currency. The costs and charges are based on the nominal amount or an assumed notional amount as specified in the table and are valid under normal market conditions.

Cost overview for MiFID Retail in the use of Multi-Dealer-Platforms (Foreign Exchange derivatives)

In case you require additional information on products and services, please contact your personal UniCredit Bank GmbH sales representative.

The detailed reporting in accordance to RTS 27 and RTS 28 could be found here.

Reporting of RTS27 is suspended since Q1/2021.

LEI (Legal Entity Identifier) of UniCredit Bank GmbH

LEI of UniCredit Bank GmbH: 2ZCNRR8UK83OBTEK2170

On the occasion of MiFID II becoming effective from the beginning of 2018, UniCredit will introduce the necessary paywalls for access to the relevant research for those clients who will fall within the remits of MiFID II.

Asset managers, who on a firm-wide basis state to us that our research is to them a minor non-monetary benefit, will be able to continue to receive our research free of charge.

For MiFID regulated clients, who cannot make such a declaration, the price will be determined on the basis of the total cost of producing and delivering the UniCredit's award winning research. Because of UniCredit's large and diverse client base, most of whom do not fall within MiFID II, we will be able to offer our high quality research to the impacted clients at relatively modest prices.

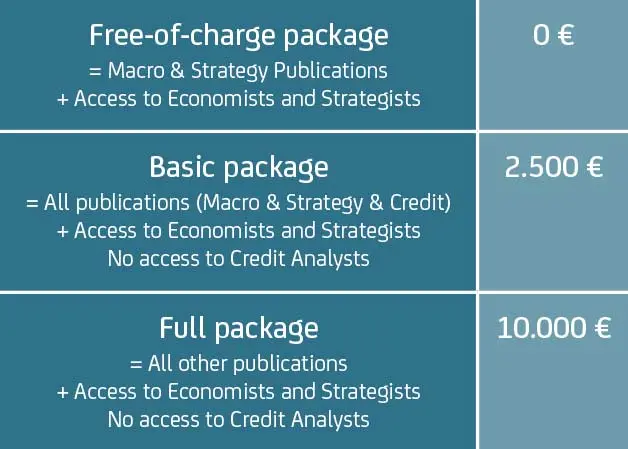

Specifically, for all UniCredit Clients, all macro and strategy research remains free. Paying will be required only for credit research. For credit research, we'll charge EUR 10,000 a year per asset manager for continued full access (i.e. Research reports and unlimited access to analysts), or EUR 2,500 for a basic package (i.e. publications-only package - no access to credit analysts).

Clients within the MiFID II remit, who do not provide a statement of "minor non-monetary benefit" or sign up to one of these two options, will lose access to our single-name credit research as of 3January 2018.

At a glance

- With the implementation of MiFID II applying to Research as of 3 January 2018, European asset managers will have to pay for some research services.

- Research is an inducement, but in many cases one of the acceptable inducements, the so-called minor non-monetary benefits (MNMB), which are allowed to be received/provided free of charge.

- The intention of UniCredit's research pricing methodology is to give our clients the possibility to consume our research as easily as possible.

- We do not intend to have European asset managers subsidize all our research costs. We bear in mind that we do not produce research for European asset managers only.

UniCredit´s "easy-to-deal-with" approach

EUR 10,000 for the full package

EUR 2,500 for access to all publications

- Prices are annual flat-fees.

- Unlimited access to all users of the client's group.

- We consider a huge part of our research as qualifying as acceptable minor non-monetary benefits and therefore as acceptable inducements, which can be consumed free of charge by most of our asset managers.

- Asset managers, who on a firm-wide basis confirm to us that our research is a minor non-monetary benefit to them or who are not subject to inducement provisions under MiFID II for other reasons, will be able to continue to receive our research free of charge.

- Individual selection of publications and services possible.

- Access to "UniCredit Research Portal" and to external aggregators is included (Bloomberg, UniCredit Research Portal, Factset, Thomson Reuters and S&P Capital IQ).

- To receive a draft contract, please send an email to your UniCredit Sales respresentative.

UniCredit Research´s offer

Free of Charge package = EUR 0

Basic Package = EUR 2,500

Free of charge package + all credit publications. No access to credit analysts

Credit Publications:

- Euro Credit Pilot

- Strategy Flash

- Securitization Market Watch

- Covered Bonds & Agency Monitoring

- Daily Credit Briefing

- High Yield Daily / High Yield Pacenotes

- Credit Flashes

Full package = EUR 10,000

Access to Credit Analysts via

- Email/Chat/Phone

- Data requests

- 1:1

- Access to Senior Executives

UniCredit Research

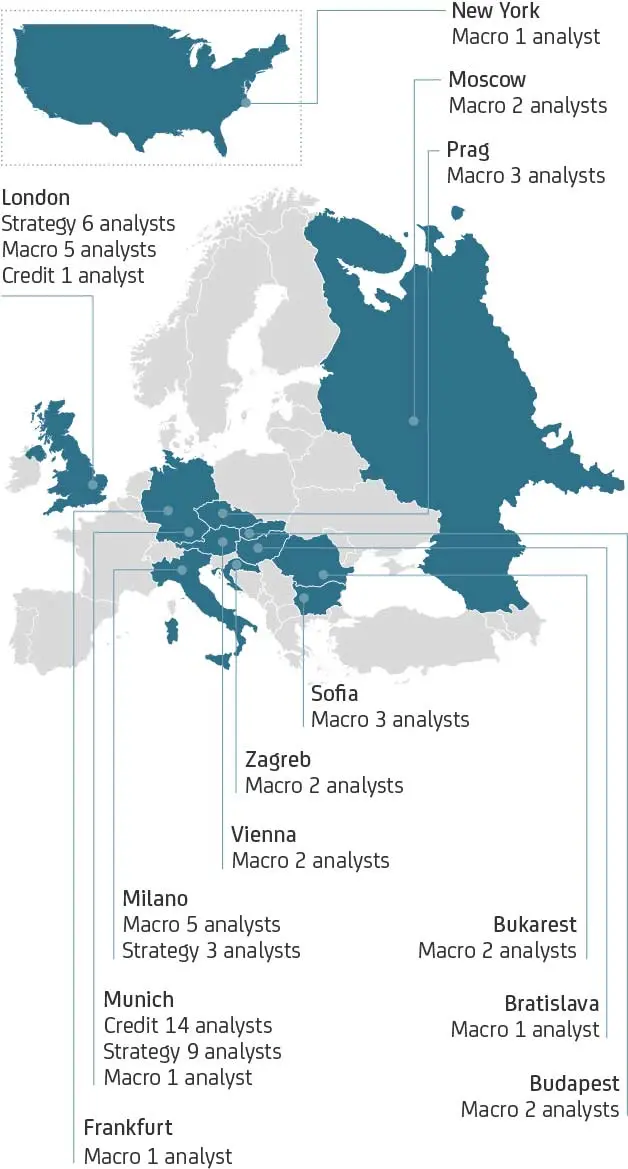

Local presence in 13 locations

Fixed Income and Credit Research´s rankings & awards

- UniCredit Credit Research once again secures high rankings in the Euromoney poll

- UniCredit's Credit Research has achieved good rankings in the Euromoney poll, with an average top-5 overall ranking in the last six years.

- The Euromoney poll is the benchmark pan-European investor survey for credit research, covering the top-20 US and European banks.

- UniCredit was ranked No. 6 overall in Europe and has top rankings in its home markets of Italy, Germany and Austria.

The poll results highlight the following:

- UniCredit's position as a strong competitive force at the forefront of European research

- CIB's robust debt value chain

Global Capital Bond Awards 2017: #3 Most Impressive Bond Research

*FI Strategy, **CEE Economics, ***Includes Regulatory & Accounting Service, ****average of all categories in which UniCredit Research has a top-10 ranking; Source: Euromoney, UniCredit Research

Below you find some selected official policies of UniCredit Bank GmbH as to important topics of MIFID II regulation:

Information concerning financial instruments

According to Article 4 MiFID II UniCredit Bank GmbH is a Systematic Internaliser for the following classes or subclasses of financial instruments:

- Shares (SHR): Selected shares admitted to a European regulated market

- Securitized Derivatives (SDR): All structured derivatives issued by UniCredit Bank GmbH

- Bonds (BON): All bonds, including convertible bonds

- Structured Finance Products (SFP): All Structured Finance Products (ABS-type securities)

UniCredit Bank GmbH registered (opt-in application) with BaFin as the applicable National Competent Authority.

Relevant financial instruments are traded/offered via trading venues or over-the counter. Future changes of registration status will be communicated by UniCredit Bank GmbH.

UniCredit Bank GmbH will fulfil the regulatory requirements concerning trade transparency via the APA/ARM Dt. Börse (Delegated Act (EU) 2017/583 and 2017/587 Article 20 and 21 MiFIR) and will publish quarterly quality of execution reports (Delegated Act (EU) 2016/3333 in addition to Directive 2014/65/EU) on the internet https://www.hvb.de/mifid.

UniCredit Bank GmbH’s identifiers are:

MIC Code: UCDE

LEI: 2ZCNRR8UK83OBTEK2170

Terms of business and access to published quotes according to Article 14 and Article 18 MiFIR are determined in following document:

According to Article 30(1) of MiFIR indirect clearing arrangements with regard to exchange-traded derivatives (ETDs) are permissible provided that those arrangements do (i) not increase counterparty risk and (ii) ensure that the counterparty benefits from a protection with equivalent effect to the one which is guaranteed for direct clients by Articles 39 and 48 of Regulation (EU) No. 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives central counterparties and trade repositories (EMIR).

All products of UniCredit Bank GmbH are covered by the new product approval process. The process ensures that the products are compliant with the relevant regulatory requirements (incl. MiFID II product governance); in particular with regard to the definition and approval of target market and distribution strategy, the management of conflict of interest, the assessment of poor outcomes (scenario analyses), the assessment of appropriate charging structures and events that could materially affect the potential risk to investors.

EMIR – European Market Infrastructure Regulation Mandatory publications

UniCredit Bank GmbH is a "financial counterparty" as defined in EMIR and our LEI No. is:

2ZCNRR8UK83OBTEK2170.

UniCredit Bank GmbH is a financial institution in category 1 regarding the clearing obligation of interest rate derivatives in EUR, GBP, JPY, USD, NOK, PLN and SEK. As well as a financial institution in category 2 regarding the clearing obligation of credit derivatives.

In accordance with article 36 EMIR (EU 2016/2251) UniCredit Bank GmbH does comply with their initial margin obligation by 1st September 2018.

Swiss FMIA

UniCredit Bank GmbH is a "Large Financial Counterparty (FC+)" as defined in Swiss Federal Act on Market Infrastructures and Market Conduct in Securities and Derivatives Trading of 19 June 2015 ("FMIA")

Dodd-Frank

UniCredit Bank GmbH has a preliminary registration as Swap Dealer ("SD") under CFTC, as well as a member of the "National Futures Association" ("NFA").

The following information does not apply to private individuals, as the requirements of EMIR do not apply to them. It is intended for counterparties within the meaning of Article 2 (8)-(10).

Under the provisions of the European Market Infrastructure Regulation 648/2012 of 4 July 2012 (EMIR), central counterparties (CCPs) and their clearing members shall offer their clients (FCs, NFCs) at least the choice between omnibus client and individual client account segregation.

Below you will find information on these types of account segregation, the level of protection and the related costs, fees and risks.

UniCredit Bank GmbH is required pursuant to Art. 39 (7) EMIR to make this information publicly available. These publications will be updated from time to time.

Please contact your account manager if you have any questions.

Please download:

Information document about the legal framework to the client account segragation

Obligatory Publication:

Attached intra-group OTC-derivatives volumes were fully exempted from regulation (EU) No. 648/2012 ("Margin RTS") due to Art. 11 (6) EMIR

FATCA and CRS

FATCA and CRS are international procedures for exchanging information on financial accounts.

The aim is to promote tax honesty and create tax transparency at a global level.

The abbreviation FATCA stands for Foreign Account Tax Compliance Act. The associated regulations lead to the fact that Germany – along with a number of other countries – is exchanging information on financial accounts with the USA.

CRS, the Common Reporting Standard, ensures that Germany and more than 100 other countries - with the exception of the USA - exchange financial account information with each other.

For Germany, the relevant legal bases for FATCA are the “Gesetz zum FATCA-Abkommen” and the “FATCA-USA-Umsetzungsverordnung (FATCA-USA-UmsV)“ and for CRS the “Gesetz zum automatischen Austausch von Informationen über Finanzkonten in Steuersachen (FKAustG)“.

To carry out this exchange, financial institutions are required to collect information on their clients and their financial accounts under both FATCA and CRS. This is done by means of the FATCA/CRS self-certification.

If a client has his tax residence abroad, certain data such as name, address, country of tax residence, tax identification number (TIN) and account balance or value are reported to the Federal Central Tax Office, Bundeszentralamt für Steuern (BZSt), at the end of the respective calendar year on a fixed date of the following year.

Subsequently, these data will be forwarded by the BZSt to the Internal Revenue Service (IRS), the tax authority of the USA, for FATCA and to the respective tax authorities of the participating countries with regard to CRS.

In this video FATCA is briefly explained.

The collection of the necessary data to carry out the exchange of financial account information on FATCA and CRS is carried out by means of the FATCA/CRS self-certification. Due to your legal obligation to cooperate, you as a client must fill out this self-certification.

If you do not provide the self-certification correctly or completely or do not provide the notification of the newly applicable statements in the event of any change in circumstances, or do not provide it correctly, completely or in a timely manner, this can be punished by a fine of up to ten thousand euros acc. to Sec. 28 (1a) FKAustG.

If you have any questions when filling out the FATCA/CRS self-certification, please contact your tax advisor, as UniCredit Bank GmbH is not allowed to provide tax advice.

Forms & Filling Instructions for FATCA/CRS self-certification

Individuals / Natürliche Personen

Service-FATCA-CRS-Self-Certification-Individuals-en (PDF, 131.92 KB)

Service-FATCA-CRS-Filling-instruction-for-customers-individuals-en (PDF, 556.95 KB)

Service-FATCA-CRS-Selbstauskunft-natuerliche-Personen-de (PDF, 141.97 KB)

Service-FATCA-CRS-Ausfuellhilfe-Kunden-natuerliche-Person-de (PDF, 115.54 KB)

Legal Entities / Juristische Personen

Service-FATCA-CRS-Self-Certification-Legal-Entities-de (PDF, 698.90 KB)

Service-FATCA-CRS-Filling-instruction-for-customers-Legal-Entities-en (PDF, 556.95 KB)

Service-FATCA-CRS-Selbstauskunft-Juristische-Person-de (PDF, 706.11 KB)

Service-FATCA-CRS-Ausfuellhilfe-Juristische-Person-de (PDF, 122.87 KB)

If we have asked you by letter to submit a FATCA/CRS self-certification, please send it back to the address of your relationship manager given in the letter. Alternatively, please use the following postal address of UniCredit Bank GmbH:

UniCredit Bank GmbH

Arabellastraße 12

81925 Munich

Qualified Intermediary Agreement for U.S. Withholding Tax

UniCredit Bank GmbH has concluded a contract under private law with the Internal Revenue Service (IRS), the tax authority of the USA, the so-called Qualified Intermediary Agreement.

Under this agreement, UniCredit Bank GmbH is authorized, on the one hand, to calculate the U.S. withholding tax of certain U.S.-sourced capital gains for its clients on behalf of the IRS and, on the other hand, is obliged to deposit the corresponding U.S. withholding tax with the IRS.

This gives our clients the advantage that they can immediately benefit from a reduced tax rate, provided that they are eligible and comply with all their documentation obligations towards us.

These documentation obligations on the part of the clients may include the submission of W-forms.

The corresponding W-forms as well as further information are available on the website of the Internal Revenue Service (IRS), the tax authority of the USA, www.irs.gov. The forms are only available in English.

Please note the following formal instructions:

- All country related data should be given in English (e.g., your nationality, your country of residence and the country whose double taxation treaty you wish to claim).

- Please provide all dates in American format (MM DD YYYY). This also applies to the date on your signature.

- If you have a U.S. Taxpayer Identification Number (US-TIN), please include it on the form.

- Please fill out the form in block letters.

If you have any further questions when filling out the W-form, please contact your tax advisor, as UniCredit Bank GmbH is not allowed to provide tax advice.